🔥NEW: Empora Title CEO Megan Harris Named to Forbes 30 Under 30

Everything you need to know about Empora Title and the services we provide. Can’t find the answer you’re looking for? Please give us a call at (614) 660-5503 or email us.

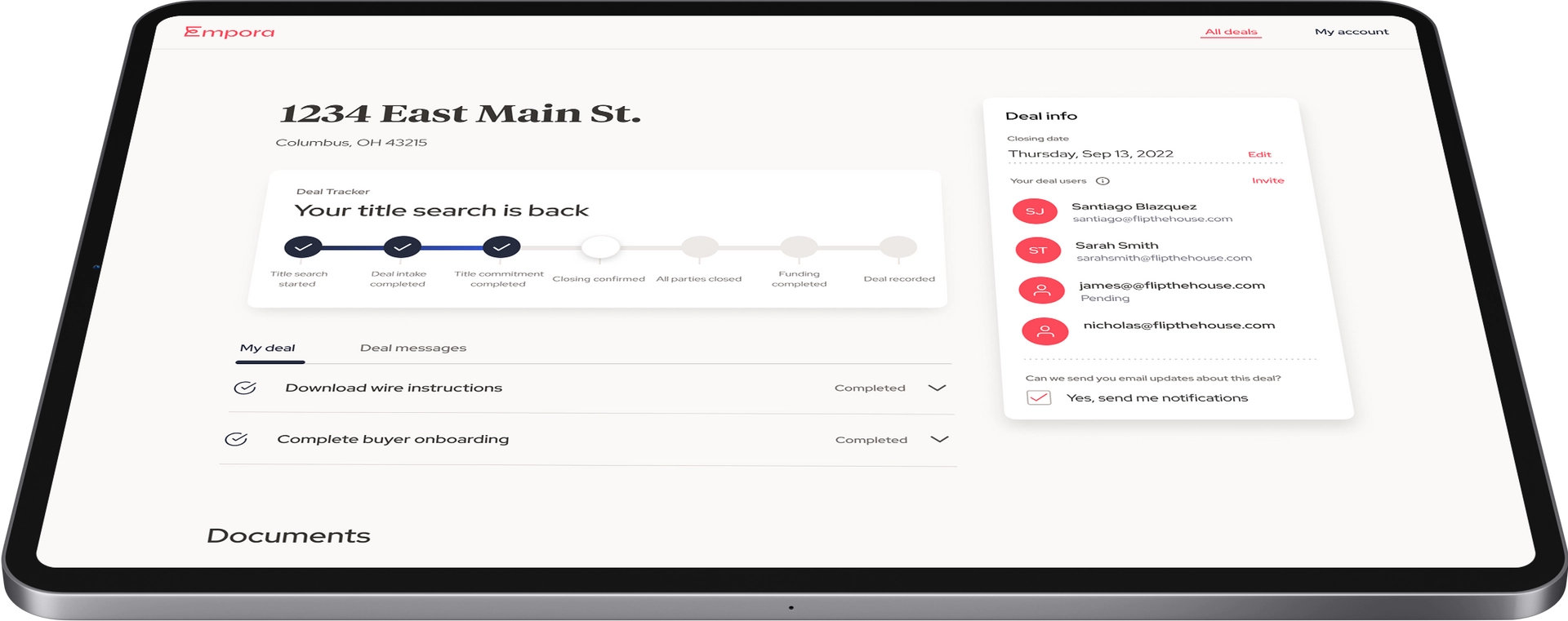

You can submit your deals directly on our site at app.emporatitle.com. You’ll provide us with the same information there as you would any other title company, then our automation ensures that once you’ve uploaded your information once, you won’t have to upload it a second time. This 2-minute video will walk you through the process.

Lenders submitting title orders or refinance packages should email them to closing@emporatitle.com or fax them to (614) 392-8723.

There are 2 ways to sign-up for an online account. You can sign-up using an email and password or you can sign-up with an existing Google account.

Sign-up with a Google Account: FASTEST! Watch this short video or follow the steps below:

Sign-up with an email and password: Watch this short video or follow the steps below:

You’re all set!

Still having issues logging in? To further troubleshoot, watch How to Log in to Your Account Using Email or How to Log in with Google.

Yes! If they’re on the same “deal side” or role as you, you can easily invite them to the file through the “People” page of your deal. Simply open the deal, navigate to “People” in the deal menu, and select “Invite someone to your deal” at the bottom of the page.

If you need to add someone to another side of the deal, for example a seller or assignor needing to add a buyer, you will need to reach out to your escrow team by deal message or phone to have them added.

A seller authorization is a document that allows Empora to request payoff information for loans, mortgages, and other liens on your behalf. Getting it as early as possible makes sure we can clear title as quickly as possible to move the transaction forward.

You can digitally sign an authorization in the Empora customer portal or you can print a blank copy (PDF) to fill out and send in to your escrow team. Occasionally a lienholder requires a specific form or information, but if that happens your escrow team will reach out.

For all customers, we use your social security number or employer identification number (EIN) to help distinguish you from others that may have a similar name when reviewing title and Patriot Act results.

For sellers, we are required to report any proceeds from transactions to the IRS as taxable income through a 1099, and will need your social security number or EIN to file this properly. Without this information we may not be able to disburse your funds.

If you are a foreign national or have another legitimate reason for not having a social security number or EIN, please let your escrow officer know so we can be sure to meet all regulatory requirements.

Each state handles marriage, divorce, and common property differently, and depending on the details of your transaction, we may need your current or former spouse to sign paperwork in order to properly complete the transaction.

To protect both Empora and your entity from fraudulent transactions, Empora needs to confirm that the person or people signing the documents are authorized to sign on behalf of the entity. Usually these “authorized signers” are laid out in the documents used to create and register the entity such as the operating agreement, articles of incorporation, or trust documents. If you don’t have these documents, or if the documents are unclear on who is authorized to sign, we may need you to complete some other paperwork.

Closing protection is a speciality coverage for your transaction that protects you from issues and errors or negligence on Empora’s part as your closing agent. Closing protection is not offered in all states, and in some states is required.

There are two main reasons why the amount you see for taxes on your statement may not match the tax bill from the county.

It’s possible that if you paid your utilities, they haven’t yet been reflected by the utility company. Unfortunately until they’re reflected by the utility company we still need to ensure that we collect them to keep the title clear of any possible liens.

A lien is put on a property when someone files with the county that they are owed money and want to use the property to secure payment. Most typically this is a mortgage, but could be any kind of debt from unpaid taxes or child support to credit cards and contractors. These debts must be paid as part of the transaction, and are generally taken from the sellers proceeds.

When a lien is paid off, the lienholder needs to file a release with the county to remove the lien from the property, however this doesn’t always happen in a timely manner. In most cases these are very easy to remove and can be handled without much work, however in some instances Empora may need to gather special documentation to remove these issues.

Most liens are resolved through a “payoff,” a document that Empora requests as soon as possible with the details of how much is owed and how to pay the lienholder. However, some lienholders, especially state attorney general offices and federal tax offices, can take 30-45 days to return a payoff after we’ve requested it.

In other cases there may be an ongoing court case or more complicated matter that Empora needs to wait for a judge’s ruling or work with a city or county to find a resolution to. These will depend entirely on the specific case and how long that judge or official needs to make a decision.

In any case, Empora will always make all parties aware of any issues that may affect the closing timeline.

A seller authorization is a document that allows Empora to request payoff information for loans, mortgages, and other liens on your behalf. Getting it as early as possible makes sure we can clear title as quickly as possible to move the transaction forward.

You can digitally sign an authorization in the Empora customer portal or you can print a blank copy (PDF) to fill out and send in to your escrow team. Occasionally a lienholder requires a specific form or information, but if that happens your escrow team will reach out.

There are two main reasons why the amount you see for taxes on your statement may not match the tax bill from the county.

It’s possible that if you paid your taxes, they haven’t yet been reflected by the county. Unfortunately until they’re reflected by the county we still need to ensure that we collect them to keep the title clear of any possible liens.

Yes! However, you must have proof of funds for the first closing, as we are not able to use proceeds from the sale to close the first transaction. For more information, check out our blog post on double closings.

Empora wants to make it as easy and convenient to close as possible, so we offer a wide range of ways to close your transaction:

For the ultimate ease and flexibility we always recommend using a RON or mobile notary closing whenever possible.

Your sales contract generally has a date by which the transaction must be closed. We call that your “tentative closing date” because there are many factors that affect if you can close earlier or have to close later than that date. These factors include:

Typically your escrow officer will reach out to you and set a confirmed closing appointment with you within 48 hours after the transaction is cleared to close.

To make sure the “i”s are dotted and the “t”s are crossed, a notary will need to verify certain information and documents with you. Please make sure to bring:

If you are closing with a remote online notary (RON) you will also need a device such as a phone, tablet, or computer with a webcam and a stable internet connection.

A remote online notary (RON) is a way to notarize official documents through a video call with a notary public. RONs are becoming increasingly available and are a great and flexible way to close on a transaction when able.

Empora partners with a RON provider called Proof to provide a secure and easy to use system. If you have a RON scheduled, keep an eye out for an email from Proof with a link to your notary appointment and instructions. You will need a device with a camera, such as a phone, tablet, or laptop, and a strong and stable internet connection. Then, when the time comes, simply open the link and follow the provided instructions to complete your signing.

If you ever have any questions during a signing, don’t hesitate to contact your escrow officer or reach Empora at (614) 660-5503, or check out our guide to RON closings (PDF).

Unfortunately, remote online notaries (RONs) aren’t available for every transaction. Some limiting factors in whether or not you can close with a RON include:

In cases where a RON isn’t an option, we can still schedule you with a mobile notary who can meet you at a time and place that’s convenient for you, or you can close in person at one of our office locations.

A mobile notary is simply a notary public, either an Empora notary or third party notary, that is able to meet you at a specified time and location to complete your signing. We will work with you to sort out the details of when and where you want to close, and send a mobile notary to meet you.

Once the signing is confirmed the notary may reach out to you directly to confirm the details. The notary will bring pens, but you will need your valid, government issued photo ID and any documents your escrow officer may have requested for closing. If you need to change your signing details once they’re confirmed, please reach out directly to your escrow officer to make any updates.

If you ever have any questions during a signing, don’t hesitate to contact your escrow officer or reach Empora at (614) 660-5503, or check out our guide to mobile notary closings (PDF).

Of course! Empora wants to make it as easy and convenient to close as possible for you, so if you need to move your closing we will work with you to find a new time or place that works for you. There are a couple of things to know:

Within 24-48 hours of your closing you should receive your finalized settlement statement. At that point you can send in your funds, however there are a few important things to know:

We do our best to fund closings scheduled before 4:00 PM eastern on the same day. Closings that happen after 4:00 PM eastern should fund the next business day. There are a few factors that may also delay funding:

In these cases we do our best to fund the transaction as soon as any delays are cleared. Remember, a wire transfer will always be the fastest and most secure way to receive your funds!

Empora can disburse funds either through a wire transfer or through an overnight check. A wire transfer will always be the fastest and most secure way to receive your funds as they typically clear within 24 hours. A check, however, will need to be sent via overnight shipping, and may take 10-15 days to clear depending on your bank’s policies and the check amount.

Due to regulations, Empora can only disburse to accounts that exactly match the names of the vested owner and sales contract. Please make sure the name(s) on your account match the names on the deed and contract.

If you plan to receive funds by wire transfer, please bring a copy of your bank information or a voided check to your closing to verify your wiring instructions. And note that some banks use a different routing number for wires than they do for checks/ACH so please verify the routing and account numbers with your bank before closing.

We service your deals through our online portal – which is backed by a large team of title curatives and escrow officers. The combination of our industry-leading technology and our world-class team is the key to our super streamlined title and closing process. Our digital platform makes it easy to upload and collect documents in one place. Email and in-portal notifications ensure you’re always up to speed on your deals. Our Deal Tracker lets you know the status of each deal at a glance, anytime, anywhere. We’re optimized for e-signings, and we let you close when and where you want.

You will have a dedicated escrow team assigned to you and you can chat with them through our portal.

If you need immediate assistance, you can always call us at (614) 660-5503.

Our digital-first experience delivers the fastest, smoothest closings possible, simplifies the management of multiple deals, and saves in closing costs on every deal.

Company

Location

145 E Rich St, Floor 4

Columbus, OH 43215

Contact

OUR PARTNERS

© 2025 Empora Title